best buy 401k rollover

Specifically RIGHT NOW is a great time to achieve this since the market is showing potentially longer term weakness that will negatively affect your retirement accounts if left unmanaged. When you do a 401k rollover you can invest in money mutual funds bond mutual funds stock mutual funds or your own companys stock.

The New Wci 401 K White Coat Investor

The top 10 of the 272 holdings make up just under 43 of the fund however so it is a bit top-heavy in its biggest names.

. Otherwise they will not have unique relationships and theyll lack the ability to provide personalized recommendations. Interesting Videos on Why You Should Buy Gold Best 401K Rollover Accounts. Each employer sponsored 401k plan has a different set of investment options available.

Gold Ira Rollover ProcessA gold IRA can just be bought actual gold be it coins or bullion. Best buy 401k rollover. Take into consideration whether you.

The best way to invest is to have a plan. The best custodians have insider connections with the top gold companies the best storage facilities and more. I am rolling over about 70k from an employer 401k into my Vanguard Traditional IRA.

You roll it over and you buy a few mutual funds pretty immediately or if you roll it into your new employers plan it immediately gets. Discover the Secret Investment Top Notch Investors Use to Counter The Ravages of Inflation. Keep reading to find out how to rollover a 401k and how its possible to use your 401k to buy real estate.

Best Buy matches 401k contributions up to your 5 contribution to a 401k plan. People can rest easy knowing that it is wholly possible to rollover a current employer 401 k to a new gold IRA. Essentially a trader earns interest on the.

Your dream of buying real estate could become a reality sooner than you think. Assigned gold accounts allow financiers to buy gold coins as well as bars from a gold broker who moves or ships the gold bars to a specific account at a vault or bank. How to Manage a 401k Gold IRA Rollover.

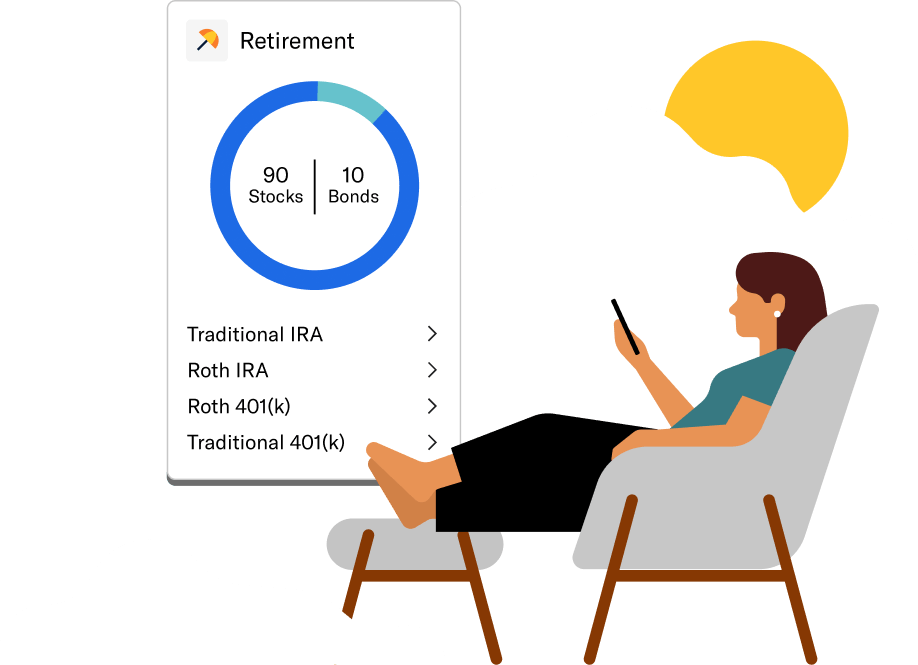

If someone wants to guarantee that their retirement is as. You can do a 401k rollover and invest in a Gold IRA Traditional IRA or a Roth IRA. Menu Skip to content.

If you meet the legal qualifications for making a conversion all you have to do is create a SDIRA buy crypto to put into it using the funds in your 401k put the alt-coin into your account fill out a couple of short forms and thats that. Doing a 401k-to-SDIRA is actually a hassle-free process. Most plans offer a variety of investment opportunities where you can do a 401k rollover.

Perth Mint has a certification program is the just one that is a government-backed rare-earth elements certificate program in the whole world. Ad Your comprehensive guide to 401k management for non-US residents is here. But the majority of 401 k rollovers are pretty immediate.

It would be best for the person to call their employer and inquire about the rules of their current 401 k and whether they are permitted to transfer or rollover a gold IRA. I know what funds etc. Now its time to fund your new Roth or traditional self-directed IRA account.

401k funds help investors save for retirement. These differences can be substantial plan-to-plan ranging from simply not having the funds youre looking to invest in to limitations around financial advice and service. Cons of rolling over a 401k to your new employer Potential investment limitations.

Ad Your comprehensive guide to 401k management for non-US residents is here. Allocated Accounts Best Time To Rollover 401K. Alloted accounts include possession of certain gold coins as well as the owner has an ownership passion in the individual coins or.

Top 3 Gold 401k Rollover Companies at a Glance. I want to invest in but after the rollover is complete I dont want to do a lump sum investment all at once. Thats because to buy real estate you generally need to make a down payment which can be very expensive.

Earn 70000 american airlines aadvantage bonus best 401k rollover deals miles after spending 4000 in purchases within. In foreign exchange trading a loss caused by an unfavorable difference in daily interest rates between the currencies being traded. Co best buy co inc.

This is a critical time for climate action and best buy is doing our part to save our planet and create a more sustainable world for our employees and the communities we serve. The best time to roll over your 401 k 457 b or 403 b account into a Rollover IRA is at a cyclical top or bottom in the market. Id like to do some form of dollar-cost averaging but dont know the best method to proceed.

Best 401k rollover companies Facts About Scott Carter Revealed. 3 Initiating the 401k Rollover. However if you have a 401k great news.

July 27 2017 a1wocov915 Leave a comment. The Best Buy Gold And Silver Website 0279.

Solo 401 K Rollover Vs Contribution Ira Financial Group

Understanding The Ira To 401k Reverse Rollover

Reporting 401k Rollover Into Ira H R Block

How To Roll Over Your 401 K And Why Ally

401 K Rollover To Ira Forbes Advisor

How To Execute A 401 K To Gold Ira Rollover Smartasset

The Best Places To Rollover Your 401 K In 2022 Benzinga

401 K Rollover The Complete Guide 2022

How To Move 401k To Gold Without Penalty 401k To Gold Ira Rollover Guide

Betterment Rollover 401k What Is It And How Does 401k Rollover Work

401 K To Ira Rollover Rules Under The Cares Act Ira Financial Group

How Long Do I Have To Rollover My 401 K From A Previous Employer

401 K Rollovers When One Is In Your Best Interest By Eric Droblyen Medium

How To Rollover An Old 401 K The Motley Fool

The Complete 401k Rollover To Ira Guide Good Financial Cents

401 K Rollover How To Roll Over A 401 K

Roll Over A 401k Or Ira Rollovers

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity